Credit Report – Reporting Issues

“Character is much easier kept than recovered.”

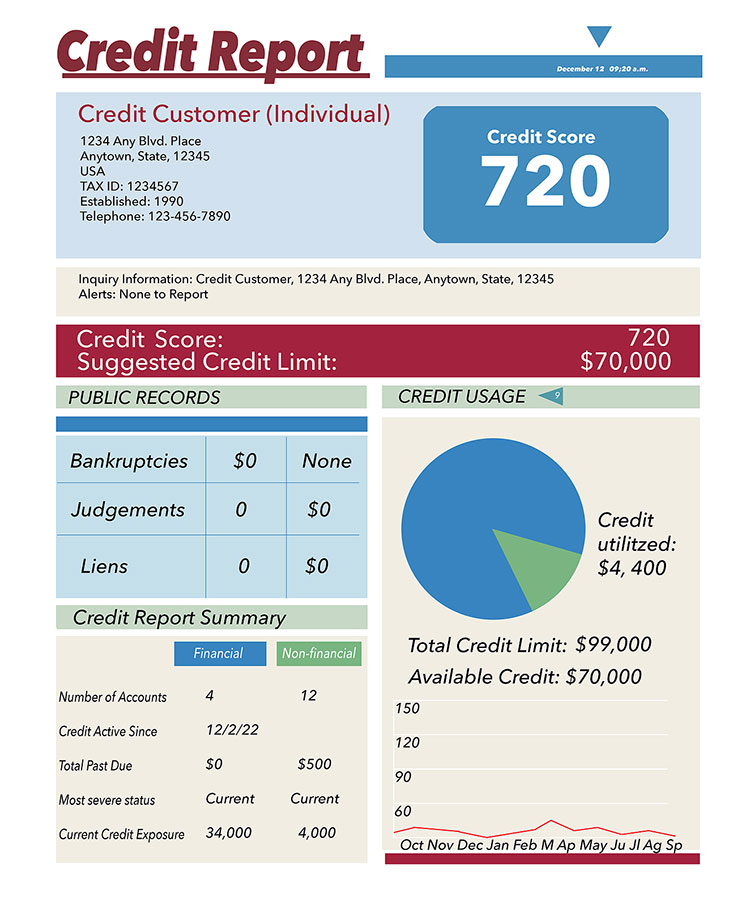

It is hard work and takes time to build and establish your credit reputation. You don’t need any mistakes showing up on your credit report to destroy the reputation you have worked so hard to build. These mistakes can affect your ability to get a loan, open a credit card, rent an apartment, try to buy a home, or even apply for a job.

If a creditor, a consumer reporting agency (e.g. Equifax, Experian, or Transunion), or a business provided inaccurate information about your credit, a Fair Credit Reporting Act attorney at the Consumer Justice Law Center can help.

The Fair Credit Reporting Act (FCRA) is a federal law regulating consumer reporting agencies and the parties who furnish (furnishers) these agencies with information about your credit.

Credit Reporting Agencies gather and report information about you and your credit to businesses, banks, and even to employers and landlords. It’s sensitive information, and it must be correct. If not, it could cost you thousands of dollars in higher rates for everything from insurance to a mortgage, or you could be denied credit, housing, or a job.

What does the Fair Credit Reporting Act require?

The Fair Credit Reporting Act requires credit reporting agencies to take reasonable measures to ensure the accuracy and confidentiality of information they report about you. Surprisingly, despite this requirement, the Consumer Financial Protection Bureau estimates that 76% of consumers have inaccurate information on their credit report.

The reporting of inaccurate information can damage your credit score and disqualify you for a mortgage or auto loan. These is simply no excuse for these costly mistakes that can destroy the credit reputation you have worked so hard to build.

Protecting yourself from inaccurate credit reporting

We recommend that you pull and review your credit report for mistakes at least once a year. Inaccurate information on your credit report may include the following:

- Reporting a balance after a bankruptcy

- Reporting someone else’s information on your report

- Reporting on-time payments as late

- Inaccurately reporting the amount you still owe on a debt

If there’s a mistake on your credit report, you can have it corrected. Send the Credit Reporting Agencies and creditor a dispute letter explaining the mistake and provide the correct information. Make sure the letter is sent by mail with a tracking number to prove the Credit Reporting Agency and Creditor received it.

The dispute letter will require the Credit Reporting Agency to investigate the mistake and fix it. If the Credit Reporting Agency fails to do that, immediately contact us at the Consumer Justice Law Center.

Please note that anyone who requests your credit information must have a legitimate reason, so the FCRA also prevents credit reporting agencies from sharing your credit information with anyone who doesn’t have a permissible purpose.

You have rights under the Fair Credit Reporting Act and we can protect them

If you believe that a Credit Reporting Agency is reporting inaccurate information on your credit report or that a creditor is furnishing incorrect information to the Credit Reporting Agencies, you may be able to sue for damages.

As Fair Credit Reporting Act lawyers with multiple offices throughout California, we can protect and fight aggressively to enforce your rights under the Fair Credit Reporting Act.

Contact us today and schedule a time to tell us your story. We’ll work with you to ensure that your credit report is accurate.