Credit Report – Mixed Profile

Credit Report Errors (junior/senior/sibling confusion)

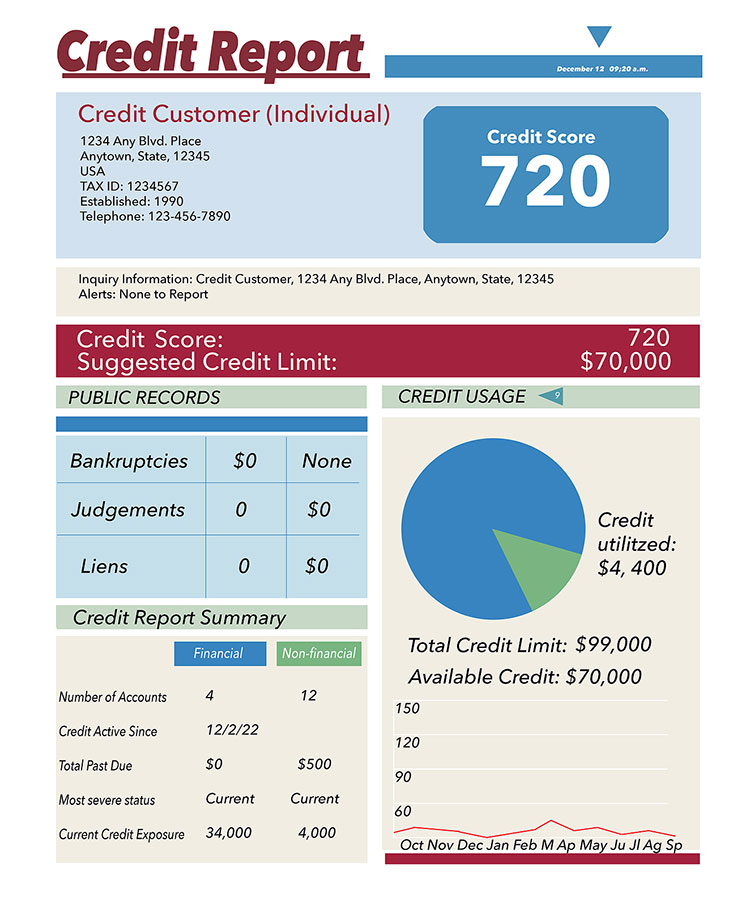

It is hard work and takes time to build and establish your credit reputation. You don’t need any mistakes showing up on your credit report to destroy the reputation you have worked so hard to build. These mistakes can affect your ability to get a loan, open a credit card, rent an apartment, try to buy a home, or even apply for a job.

If a creditor, a consumer reporting agency (e.g. Equifax, Experian, or Transunion), or a business provided inaccurate information about your credit, a Fair Credit Reporting Act attorney at the Consumer Justice Law Center can help.

Common credit reporting errors includes the mixing of credit information between separate individuals. Credit information between juniors and seniors or siblings within the same family can sometimes appears on each other’s credit profiles inaccurately. Call us today to assess the

impact of mixed/inaccurate credit information on your credit report.

What does the Fair Credit Reporting Act require?

The Fair Credit Reporting Act requires credit reporting agencies to take reasonable measures to ensure the accuracy and confidentiality of information they report about you. Surprisingly, despite this requirement, the Consumer Financial Protection Bureau estimates that 76% of consumers have inaccurate information on their credit report.

The reporting of inaccurate information can damage your credit score and disqualify you for a mortgage or auto loan. These is simply no excuse for these costly mistakes that can destroy the credit reputation you have worked so hard to build.

Protecting yourself from inaccurate credit reporting

We recommend that you pull and review your credit report for mistakes at least once a year. Inaccurate information on your credit report may include the following:

- Credit reporting errors can be frustrating and complex issues, particularly when they involve name and identity mix-ups such as between individuals who share the same names. This can happen due to similarities in personal information, such as names, addresses or Social Security

numbers. Common credit report errors relating to name mix-ups include:

1. Junior/Senior name confusion – When a senior’s credit information appears on the junior’s credit profile, and vice-a-versa. Credit bureaus may erroneously merge two people’s credit reports, leading to serious consequences for both parties affected.

2. Siblings credit confusion – When siblings within the same family have credit report information appearing on the wrong sibling’s credit report

3. Parent/child credit confusion – Credit card companies may accidentally report a parent’s credit card account information to the wrong person’s credit report, leading to inaccuracies in credit utilization and payment history.

- Credit reporting errors can impact your credit score. The presence of another personal’s credit

information on your credit report may result in an inaccurate credit score. - Debt collection errors can also occur, where a mixed credit profile leads a debt collector to pursue an individual for debts they never incurred. Privacy concerns are also paramount due to the commingling of credit reports exposing personal financial information to unauthorized parties.

- These credit reporting mistakes can lead to significant financial consequences and make it challenging to secure loans, apply for jobs, or rent a property. It is crucial to be aware of such errors and to address and fix the errors as soon as possible. If you or someone you know has experienced a mixed credit profile due to junior/senior, sibling, or other name confusion, it is essential to consult with an experienced attorney who specializes in credit reporting and consumer protection laws. Contact us at the Consumer Justice Law Center for a free assessment on your credit reporting errors. Major credit reporting errors by credit reporting agencies and creditors can result in an award of damages that will help you to restore your credit and good name.

If there’s a mistake on your credit report, you can have it corrected. Send the Credit Reporting Agencies and creditor a dispute letter explaining the mistake and provide the correct information. Make sure the letter is sent by mail with a tracking number to prove the Credit Reporting Agency and Creditor received it.

The dispute letter will require the Credit Reporting Agency to investigate the mistake and fix it. If the Credit Reporting Agency fails to do that, immediately contact us at the Consumer Justice Law Center.

Please note that anyone who requests your credit information must have a legitimate reason, so the FCRA also prevents credit reporting agencies from sharing your credit information with anyone who doesn’t have a permissible purpose.